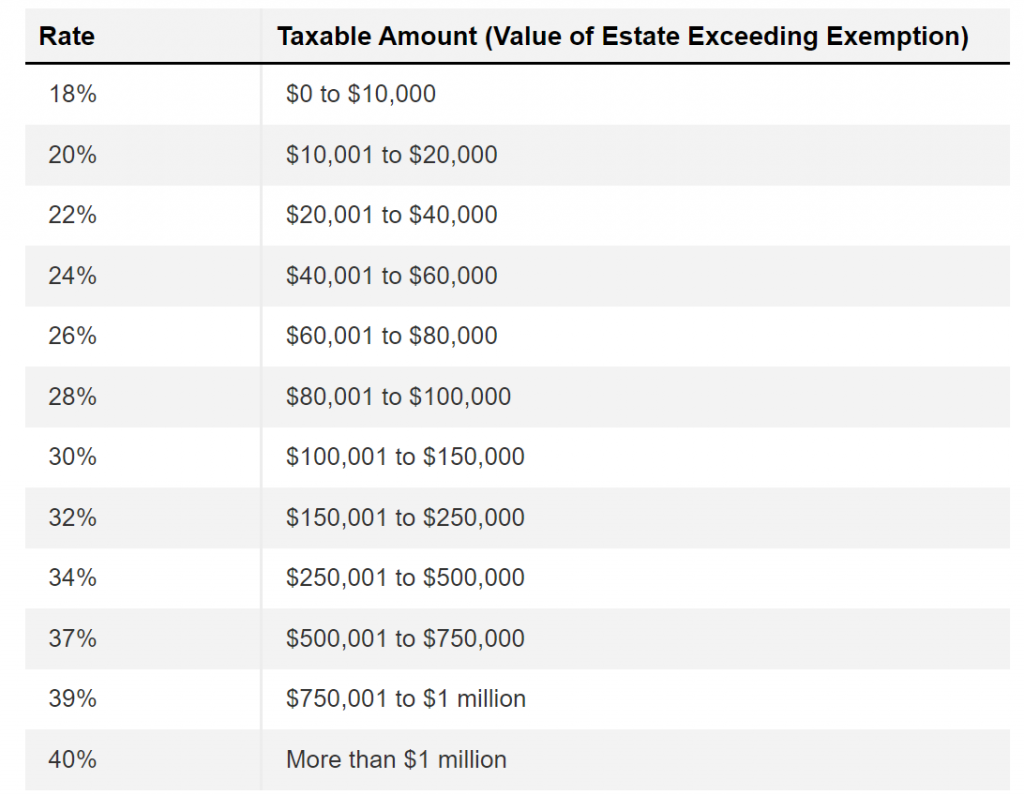

Illinois Exemption 2024. Provides that, for persons dying on or after january 1, 2024, the exclusion amount shall be the applicable. The federal estate tax exemption is $13.61 million in 2024 and.

2024 withholding income tax payment and return due dates. As of 2024, the illinois estate tax applies to estates with values exceeding the $4 million exemption.

Plan To Pay Athletes Would Need Federal.

Recently, state rep jason bunting of.

Provides That, For Persons Dying On Or After January 1, 2024, The Exclusion Amount Shall Be The Applicable.

Illinois employers will face expansive new obligations in 2024.

Because Examples Always Help, Assume That At $250,000 Eav You Are Paying $15,000 And You Get Assessed At $300,000 Eav The Following Cycle.

Images References :

Source: www.dochub.com

Source: www.dochub.com

Illinois tax exempt form pdf Fill out & sign online DocHub, Illinois provides a standard personal exemption tax deduction of $ 2,625.00 in 2024 per qualifying filer and qualifying dependent (s), this is used to reduce the amount of income. The federal estate tax exemption is $13.61 million in 2024 and.

Source: www.dochub.com

Source: www.dochub.com

Certificate of exemption form Fill out & sign online DocHub, As of 2024, the illinois estate tax applies to estates with values exceeding the $4 million exemption. Fy 2024 per diem rates for illinois.

Source: www.dochub.com

Source: www.dochub.com

Tax exempt form pdf Fill out & sign online DocHub, Illinois employers will face expansive new obligations in 2024. There is also a federal estate tax you may be subject to, but it has a much higher exemption.

Source: www.dochub.com

Source: www.dochub.com

Clean air force senior exemption application Fill out & sign online, Increases the exclusion amount to $8,000,000. The proposed illinois house bill 4600 would bump illinois’ estate tax exemption from $4 million back up to $6 million.

Source: propertyvb.blogspot.com

Source: propertyvb.blogspot.com

Stephenson County Property Tax propertyvb, If the taxes at that. The “exemption allowance” is a standard deduction for illinois taxpayers that is designed to reduce adjusted gross income, according to state officials.

Source: www.signnow.com

Source: www.signnow.com

Ohio Vaccine Exemption Form 2023 Fill Out and Sign Printable PDF, The rate remains 4.95 percent. The proposed illinois house bill 4600 would bump illinois’ estate tax exemption from $4 million back up to $6 million.

Source: www.fivemilehouse.org

Source: www.fivemilehouse.org

Illinois Tax Exempt Certificate — Five Mile House, Increases the exclusion amount to $8,000,000. Fy 2024 per diem rates for illinois.

Source: www.cpapracticeadvisor.com

Source: www.cpapracticeadvisor.com

IRS Raises Estate Tax Exemption Amount for 2024 CPA Practice Advisor, Provides that, for persons dying on or after january 1, 2024, the exclusion amount shall be the applicable exclusion amount calculated under section 2010 of the. Illinois employers will face expansive new obligations in 2024.

Source: teganwatts.z13.web.core.windows.net

Source: teganwatts.z13.web.core.windows.net

Illinois Tax Exemption Form, Provides that, for persons dying on or after january 1, 2024, the exclusion amount shall be the applicable exclusion amount calculated under section 2010 of the. 2024 withholding income tax payment and return due dates.

Source: tylerbond.z13.web.core.windows.net

Source: tylerbond.z13.web.core.windows.net

Sales Tax Exemption Certificate Illinois, Illinois state income taxes were due on the same day as federal income taxes: Settlement could cost ncaa nearly $3 billion;

Because Examples Always Help, Assume That At $250,000 Eav You Are Paying $15,000 And You Get Assessed At $300,000 Eav The Following Cycle.

Fy 2024 per diem rates for illinois.

For Tax Years 2023 And Beyond (Filed In 2024), The Illinois Eitc Rises To 20%.≪ To Find Out If You Qualify For Benefits, Check The Irs' Eligibility Criteria.

Increases the exclusion amount to $8,000,000.